Chqbook for Small Businesses

Description of Chqbook for Small Businesses

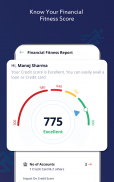

Chqbook is a mobile application designed specifically for small business owners in India, offering a range of financial products and services tailored to their needs. This app has gained popularity among various proprietorship businesses, including Kiranas, merchants, and chemists. Users can download Chqbook on the Android platform to access its unique offerings.

One of the primary features of Chqbook is its banking services. It provides India’s first instant zero-balance current account, allowing users to initiate and manage their finances without the need for maintaining a minimum balance. Users can perform instant fund transfers at zero fees, making it a cost-effective solution for daily transactions. The app supports multiple languages, including Hindi, English, Hinglish, Kannada, Telugu, Marathi, and Bengali, ensuring accessibility for a diverse user base. Additionally, users can download account statements with a single click on their mobile devices.

Chqbook places a strong emphasis on safety and security. The app implements multiple verification checks to authenticate users, starting with mobile number verification through an OTP (One-Time Password). It also utilizes a process called sim binding to prevent fraud. When accessing the banking section, the app generates a unique code for the mobile number used during OTP verification. This code is then verified by the backend system, allowing users to proceed only if the verification is successful.

The app also supports financial transactions such as NEFT and IMPS, enabling users to send money to any bank account in India efficiently. This capability is particularly useful for small business owners who need to manage their cash flow and make payments on time.

For businesses seeking financial assistance, Chqbook offers business loans with competitive interest rates. Users can apply for loans through the app, which features a fast processing system and speedy disbursal. The repayment tenure for these loans ranges from one to five years, with annual percentage rates (APR) varying between 17% and 32%, depending on individual profiles and the lending institution. The app also features rewards for loan disbursement, providing an added incentive for users.

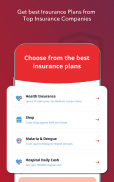

Insurance options are another significant component of Chqbook. The app allows users to secure various types of insurance, including car, bike, life, health, and shop insurance. The process for obtaining insurance is streamlined, with no medical examinations required, resulting in instant policy issuance. This feature can be particularly beneficial for small business owners seeking to protect their assets and ensure continuity.

Chqbook is developed by Nineroot Technologies Private Limited and has made significant strides since its launch in September 2020. The app has been downloaded by over 1.5 million customers across 500 cities in India, reflecting its growing popularity among small business owners. By focusing on the unique needs of this demographic, Chqbook aims to empower entrepreneurs and help them manage their financial activities more effectively.

The app's user interface is designed to be intuitive and user-friendly, making it accessible for individuals who may not have extensive experience with financial applications. This focus on usability is complemented by the app's diverse language support, which further enhances its appeal to users from various backgrounds.

Chqbook also prioritizes customer support, offering a grievance redressal system facilitated by Karanpreet Singh. Users can reach out for assistance through various channels, including a dedicated contact number and email address. This commitment to customer service ensures that users have the support they need as they navigate the app's features.

In addition to the aforementioned features, Chqbook provides a platform for facilitating money-lending activities in collaboration with registered Non-Banking Financial Companies (NBFCs) and banks. This partnership with reputable financial institutions helps users access the financial products they require, ensuring a seamless experience for small business owners.

Through its comprehensive suite of features, Chqbook addresses the various financial needs of small business owners, from banking and loans to insurance and customer support. The app serves as a valuable tool for entrepreneurs looking to streamline their financial operations and enhance their business growth. As small business owners continue to seek efficient solutions for managing their finances, Chqbook stands out as a dedicated resource in the Indian market.

For more information regarding the app and its offerings, users can refer to Chqbook's privacy policy at https://www.chqbook.com/privacy/.